ASPIM Growth

It takes a true partnership to help clients achieve their goals. Combining the best of financial planning, investment management and client service.

ASPIM Growth

The growth portfolios are for investors who are looking for growth and income by investing in a diversified range of assets and markets worldwide.

Key benefits

-

10 portfolios, risk profiled 2-11

-

Multi-asset portfolios

-

Actively managed portfolios

Fees

-

DFM fee 0.25%

-

Ongoing charge (OCF) 0.49%*

*at 31.10.2025. Based on ASPIM Growth 5. See factsheet for latest OCFs.

Independently risk profiled by:

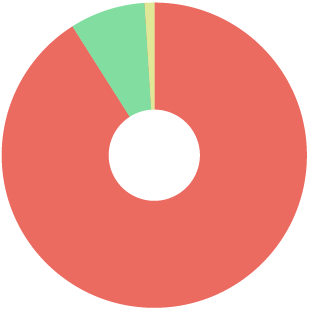

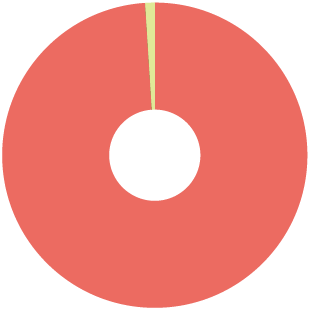

Strategic asset allocation

ASPIM Growth 2

ASPIM Growth 3

ASPIM Growth 4

ASPIM Growth 5

ASPIM Growth 6

ASPIM Growth 7

ASPIM Growth 8

ASPIM Growth 9

ASPIM Growth 10

ASPIM Growth Equity

Equity

Fixed interest

Alternatives

Cash

For illustrative purposes only. The Strategic Asset Allocation (SAA) is reviewed and updated annually. Data at 30.11.2025. Please refer to the latest factsheet for the current asset allocation.

Related documents

MPS Brochure

SERVICES

COMMERCIAL

SERVICES

INDUSTRIAL

SERVICES

RESIDENTIAL